what to do if you cant afford your medical bills

In the United States, the handling costs of a single illness, blow or pregnancy can easily reach five figures. Even with insurance, that tin can leave you with an centre-popping residuum due. Hither, straightforward strategies to handle medical bills you can't afford.

You're young. You lot're healthy. But that doesn't hateful y'all won't have a medical emergency tomorrow and go stuck with some whopping bills. These bills tin get overwhelming really fast and it can be tempting to merely ignore them.

Only let'south be articulate hither—you do have to pay them. According to the Federal Reserve, the credit scores of two in five Americans were negatively affected by medical bills. 1 in vi credit reports contains a medical debt.

If you lot become slapped with a big infirmary or doctor'due south nib, brand sure you lot follow these steps:

Make sure the charges are accurate

I reason why medical intendance is then expensive? The organization is kind of a mess and they brand a lot of billing mistakes.

Some of the most mutual include charges for services you didn't receive and medications you never took. If yous take an extended infirmary stay, sometimes you'll get charged a full day'due south room rate even if you lot check out in the morning.

Don't ignore your bills

This signal bears repeating. Whatever you exercise, don't ignore your bills—it's one of the worst things y'all tin do. If you do, your bills will get sent to collections and non only volition you get abrasive telephone calls at all hours of the night, only your credit score will take a hard striking.

Don't use credit cards to pay off your medical bills

If you have, what seems like never-ending medical bills, you lot might exist tempted to pay them off in full with credit cards to get your doctor(due south) off your dorsum. But you lot should never use credit cards to pay off your medical bills.

Equally we've said in many of our posts before, carrying a balance on your credit card tin lead to a never-ending cycle of debt due to high-interest payments. This can have a very negative consequence on your credit score.

There'due south more room to negotiate medical bill payments, different some other debts. As long every bit you pay something, and fix a payment plan you lot can get past making smaller payments for a while. Medical payments also come with depression or no involvement, which is definitely not true of most other debts.

Work out an interest-complimentary payment plan

One thing I learned when I was dealing with a huge hospital pecker is that involvement-free payment plans exist, simply "it's oft written in the fine print on the statement," says Marcy Quattrochi, Director of Financial Counseling at NorthShore University HealthSystem.

Depending on the hospital or doctor'due south role, the amount you pay each month may be negotiable. They'll starting time out with a number that may exist besides much for you. Don't be agape to talk them down.

Ask for a prompt pay disbelieve

Some hospitals and physician's offices will give yous a ane-time discount for paying your bill in ane lump sum inside thirty days. "We have x% off," Mary says.

Some experts suggest request for even more of a discount. You tin can get some ammunition for your argument by using the Healthcare Blue Volume to see what other nearby hospitals or doctors charge for the type of care y'all received. If you were charged significantly more, you can argue you deserve a price reduction.

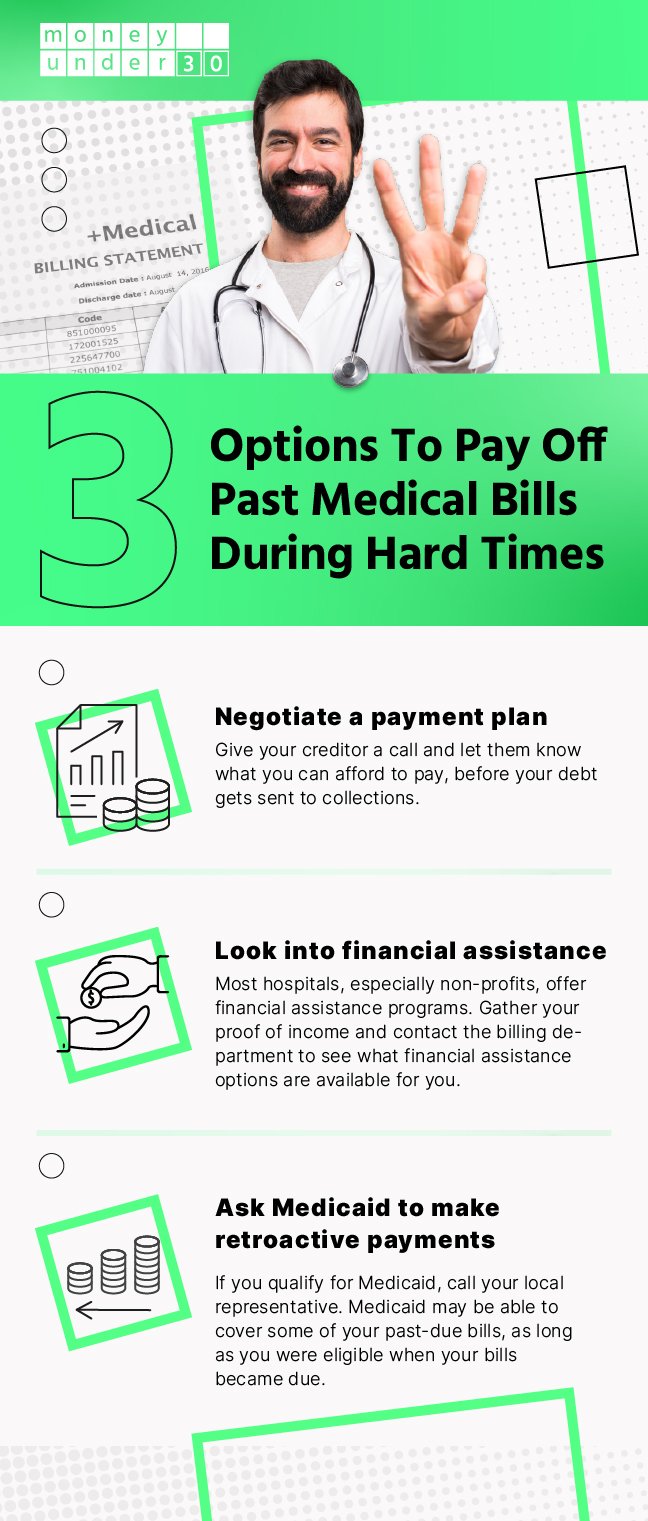

At the other finish of the calibration, if you lot tin can't afford to pay anything at all…

Apply for fiscal assist

Y'all're not a bad person if y'all autumn into this camp. A lot of people do.

Luckily, hospitals exercise offering fiscal assistance, simply each has its own process. At some, yous have to utilize for Medicaid offset (you may be eligible if you are under 26 and earn less than $15,856). If you're rejected, then you apply for help from the infirmary.

Other hospitals take an easier process, but it nevertheless requires a lot of paperwork. "Nosotros have an application that you lot must complete forth with giving us your tax returns, bank business relationship information, and paychecks," Mary says. "After nosotros review that, we determine a discount."

Hither's a list of 35 other medical assist programs that can assistance yous get your medical bills covered.

Use for a loan

Getting a loan should exist a last resort, because if you can't pay it off you'll be on the hook for the APR. That said, you'd be paying less in interest than you would if you had a rest on a credit card, which is why we're recommending you consider this selection.

If you lot're at this phase, check out Credible . They take a special section for medical expenses and they'll scour the market place and observe you the best possible rate for your specific needs.

Deal with drove agencies

If the worst has happened, and your bills accept gone to a collections agency, you need to bargain with it. Luckily, internal collections agencies (those at the hospital or doctor's office) are more willing to negotiate payment plans and hold off sending data to credit bureaus than tertiary-party debt collectors.

Here are a few tips to help make dealing with collection agencies a little less painful:

Know what collectors can do

Believe it or not, debt collectors tin't phone call you an unreasonable number of times (including earlier 8am or 9pm).

They also can't:

- Call you lot at work if you've asked them not to

- Threaten to sue y'all without meaning reason

- Tell you lot that you take committed a crime past not paying

- Threaten to tell others virtually your debt (except for your Lawyer or spouse)

- And more

Record whatever phone calls and become everything in writing

Talking with debt collectors can get heated quickly, but they aren't allowed to threaten you lot. If they practice, you take reason to sue. So make certain to record your phone calls with any debt collectors that contact you.

Once you've come up to an agreement on what you tin can pay, brand certain you go it in writing. Don't make any payments until yous have the physical document.

Also, keep all proof of payment—that way, if there'southward ever a question almost your debt you can prove that you paid what you said y'all would.

Offering to pay something

Patently debt collectors want to get the full debt paid, but be firm and offer to pay what you can. Information technology's likely that they'll accept it.

You lot should expect a counteroffer…or a couple of them. That, later on all, is what debt collectors are supposed to do. If you can pay off the debt in total, this will look much better on your credit report, but chances are you tin can't—which is how you lot got in the situation in the first identify. Just offer to pay what you can.

Summary

Information technology can exist tempting to since there'south no immediate repercussion similar there is when you don't pay a prison cell phone bill. But similar whatever business, hospitals and medical offices somewhen turn over unpaid bills to collection agencies. And once they get involved, your credit score takes a ding and negotiation gets a whole lot harder.

Read more

- Dealing With Debt Collectors: Your Rights

- Q&A: I Accept Tons of Debt and Virtually No Income. What Are My Options?

Related Tools

Save Your Kickoff - Or NEXT - $100,000

Sign Up for free weekly money tips to help you earn and salvage more than

We commit to never sharing or selling your personal data.

johnsonthable1952.blogspot.com

Source: https://www.moneyunder30.com/paying-medical-bills-you-cant-afford

Enregistrer un commentaire for "what to do if you cant afford your medical bills"